Welcome to my portfolio webpage. Here’s where you’ll find my work; words I’ve written, designs I’ve discussed and help influence, and UX I’ve worked to inform.

I appreciate your time and consideration.

Web assets:

Ads:

Long-form:

The word “retirement” can conjure plenty of different images depending on who you’re asking. Whether you see visions of Michael Jordan at the press conference, picture your grandfather casting a fishing line into a babbling brook, or simply think of people enjoying their golden years by doing exactly what they want, the picture is still the same — retirement is a cessation of work and time to enjoy life unimpeded.

In order to sustain this lifestyle, it’s imperative to put your finances first and stash away for your golden years before you decide to leave the full-time workforce. Retirement planning will take you far — if you save enough and prioritize for the years to come, early retirement can be actualized.

What does early retirement mean?

Historically, retirement has meant leaving the workforce around age 65 in order to focus on leisure and life’s enjoyment, where the retiree is supported by their Social Security Benefits and sometimes, a supplementary fund such as a pension.

However, it’s important to remember that retirement isn’t a one-size-fits-all term — it looks different for everyone. Yet in current times, people are now working on doing what they can to retire earlier.

Broadly speaking, we can define early retirement as exiting the workforce at an age earlier than 65 years old. Whether you want to remodel a chateau, get involved with local activism, or simply just chill and relax, retiring will offer you the time to do as you please. Retiring early can be a goal someone strives to achieve, which can happen with proper financial planning.

What do you need to retire early?

It’s important to decide exactly when you want to retire and crunch a few numbers to see if that age is right for you. It’s feasible if you can sustain yourself, especially if it’s before the federal retirement age — which is when you are legally entitled and eligible to receive your benefits.

Take a look at your expenses and see what you’re spending money, and which bills are going to follow you into retirement age. You’re still going to need to pay your bills associated with homeownership or renting (think utilities, internet, etc.), as well as the occasional medical bill, and lifestyle purchases, like dinner, drinks, and travel. It’s helpful to get an idea of what you’re spending monthly to know what you’ll need in the future and also, where you can curb spending currently!

In order to retire earlier than 62, you will need to start saving in order to sustain your retirement before Social Security benefits begin. Saving is crucial to early retirement — you will need to consider what your needs are, your financial obligations, and determine the amount of money you’ll need to pursue whatever leisurely activities you have in mind. After building your nest egg, tap into it when you know you’re going to be able to sustain yourself until Social Security benefits.

How can you build enough income to retire early?

If you’re sitting here reading this and thinking about retiring early, you might be feeling like this is a very daunting task. Sure — it’s not easy! But with careful planning, a commitment to saving, and maybe even a little sacrifice, you can start building a foundation upon which to retire. The goal here is financial independence, allowing you to fully live your lifestyle within the means to support yourself.

Before you retire, you need to ask yourself these two questions — click here for more.

Savings

If you want to retire early, the best thing you can do is to save, save, save. Setting aside any extra money to sustain yourself and replace a working salary is a surefire way to put your best foot forward towards retiring.

You may even want to take a look at your budget and see how much you can set aside for your retirement — it could be more than you think. The best rule of thumb is to set aside 10-15% of your salary towards retirement, but if you can stash away more, feel free! Consider opening a high-yield savings account for your savings to grow.

Social Security benefits

Social Security benefits are what normally allow individuals to retire. These benefits include replacement income for qualified individuals and their families based on their earnings — partial payout begins as early as 62 for early retirees. It’s important to note that full payout comes at the full retirement age — it’s 66 years for people who were born in 1955 or before, and 67 for anyone born after, and even as late as 70 years of age.

In order to see what you’ll qualify for, Americans can take a look at the SSA’s online benefits calculator to help get an idea of what your payout might look like.

Pension vs. 401(k)

Employer-funded retirement accounts are also a great avenue to tap into — in some cases they will match your own contributions. Let’s take a look at a few different types of retirement accounts:

Pension

A pension pool is a type of employee benefit plan where employees regularly contribute to a fund — in this case, a pool of money — which is paid out to employees after they retire. Pensions are definitely becoming more and more scarce in the private sector, they are very common in government positions, teaching, and nursing.

The two major types of pension plans are the Defined-Benefit plan, which specifies that retirees will receive a predetermined amount, regardless of performance or contribution. A Defined-Contribution plan is dependent on the amount contributed by both the employee and the employer.

401(k)

A 401(k) is a retirement savings plan that’s offered by employers throughout the United States — the name is taken from the tax code set forth by the IRC. In a 401(k), an employer will deduct a certain percentage of the employee’s income, and set it aside in an investment account — typically a mutual fund. The employer may provide a contribution, or sometimes even match the employee’s contributions.

The two most common types are a traditional 401(k) and a Roth 401(k) — the difference is that a Roth 401(k) deducts the contributions after-tax, which means there will be no additional taxes the employee will owe come tax season.

403(b)

Similar to a 401(k), the 403(b) plan, also known as a Tax-Sheltered Annuity plan, is another retirement plan offered by public school districts and certain 501(c)3 tax-exempt organizations. As with the 401(k), the 403(b) plan allows employees to make contributions to a retirement account, and again, can offer Roth contributions in order to square everything away come tax season.

It’s important to remember that with both 401(k) and 403(b) plans, you should roll your balances over to personal accounts if and when leaving your employer. Also, be prepared to pay a withdrawal fee should you decide to access your savings prior to 59 ½ years of age — the pre-defined withdrawal age.

Personal retirement accounts

The most common personal retirement accounts are IRAs, which stand for Individual Retirement Account. With this type of account, you can invest, typically with a bank or brokerage account, where your money will grow and compound. You can invest in mutual funds, stocks, bonds, and other assets — how much you earn depends on how much you contribute.

Like the employer-sponsored retirement accounts above, IRAs also have traditional and Roth varieties, which affect taxable income. Traditional IRAs can be deducted from your taxable income, but withdrawals are taxable as ordinary income.

Roth IRAs contributions are not tax-deductible, but withdrawals are tax-free and you won’t have to worry about capital gains come April — a great option for an investor a long way from retirement age.

A nice little nest egg

So let’s hypothesize for a minute — say you max out your 401(k) or IRA, you might ask yourself, “what does this look like?” While it’s a pretty difficult feat, it might be something to strive for — especially if you want to retire early.

Having maxed out an account means you’ve reached the limit you can contribute, as set forth by the IRS. This will set you up nicely for retirement income, and if you’ve gone the Roth route, you won’t need to worry about taxes. Furthermore, if your 401(k) is maxed out and your employer has contributed, you’re looking at a substantially comfortable retirement.

Build your nest egg. It’s imperative.

So, can you retire early?

Surely by now, the prospect of not having to commute, join Zoom calls, and file expense reports is sounding pretty desirable. What do you think — are you ready to retire? Let’s take a look and see if you can sustain yourself!

Calculate your net worth

Knowing exactly what your worth is super important moving into retirement. By knowing the value of your assets and seeing where your debts and liabilities lie are crucial while preparing for retirement.

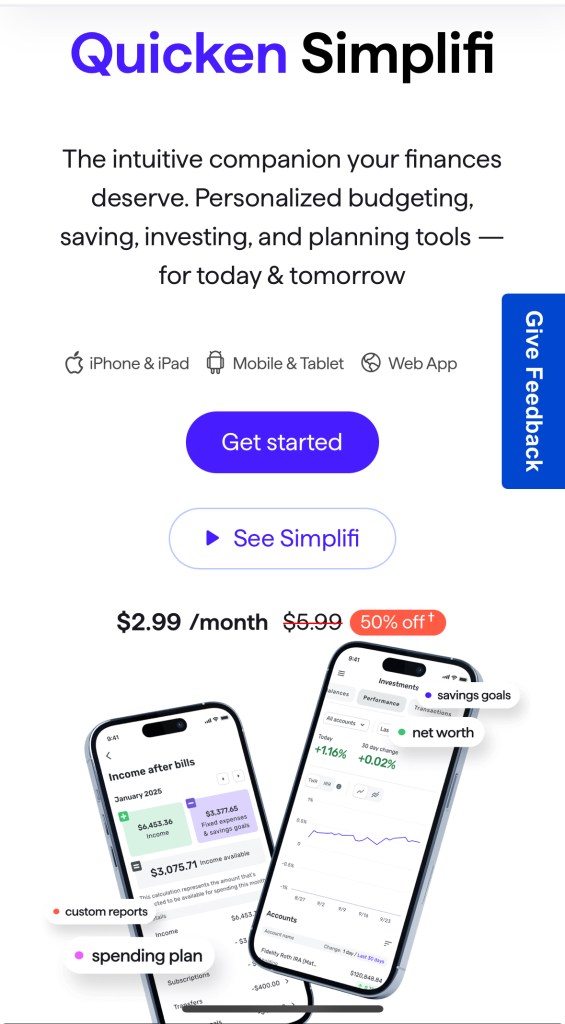

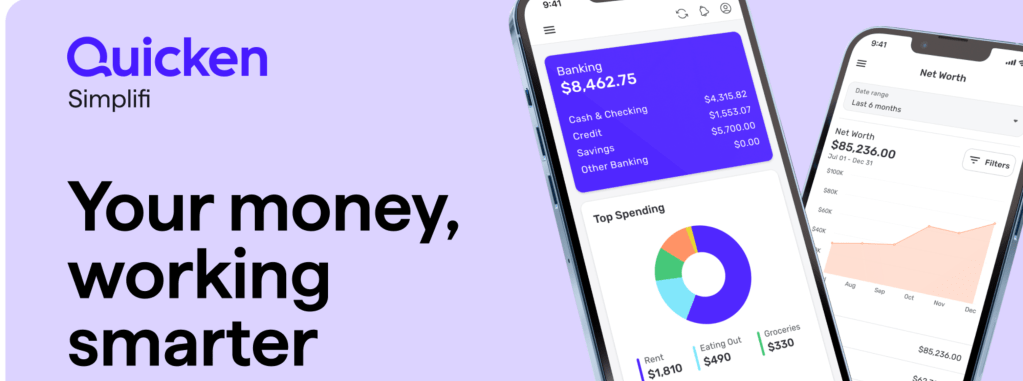

Quicken can provide you with a complete picture of your comprehensive finances and investments — use it regularly for best results.

Test a few different retirement ages

There’s no “one-size-fits-all” retirement age — it’s going to vary for everyone! Depending on your income, your savings, and obviously, your interest level in retirement, you should think long and hard about when you could see yourself settling down.

Start with a retirement calculator to help you project how much money you can expect to have at a certain age. Make sure to include any non-cash assets — this will help again to define your net worth. Also, try and decide how many retirement years you’ll need to plan for, as you’ll need to be aware of your withdrawal rate (rule of thumb is 4-5% in your first year).

Save, save, save….did we mention save?

If you’ve gotten this far, then you might be sensing a theme here.

Want to retire? Want to retire early? Save your money. Cut out frivolous spending. Stash your money in a high-yield savings account. Don’t hoard cash under your mattress. Be realistic about living expenses.

Save, save, save.

Create a budget

Budgeting is crucial — it keeps you aware of where your money is coming and going, and allows you to set money aside for retirement savings and investments.

Use Simplifi or Quicken to plan your monthly budget, set savings goals, and project your investment earnings to plan for your future.

Need help setting up your budget as your expenses change? See how Quicken can help you here.

Discuss with your family

Whatever your marital status, it’s best to discuss your retirement goals and plan with your loved ones in order to prepare for the future. While it may not be as tangible as contributing to a retirement account, relationships are the hallmark of our human experience — make sure you’re ready to slow things down with the ones you love most by planning the future together.

Balance your investment portfolio

Try not to keep cash as an investment asset, unless you’ve budgeted spending money or have an emergency fund on-hand. Instead, consider splitting the rest of your nest egg in investments across safer bets — index ETFs or bonds are a safe bet, especially if you’re hedging against inflation and rising interest rates.

Research health insurance

As the old saying goes, health is wealth — your investing is worthless if you’re not around to use it. If you decide to retire early, keep in mind that Medicare won’t (usually) kick in until you’re 65. Do some research into health care should you decide to leave the workforce prior to the Medicare qualifying age, and remember, cheaper premiums can also carry high deductibles.

Get back to work…

…part-time, that is! Many retirees can struggle with a lack of structure in their lives due to their work obligations stopping. A good way to remedy this (as well as provide a little extra spending money) is to work part-time.

Whether you pick up a gig ridesharing, try your hand at real estate, or even bartending, a part-time job can provide a sense of accountability and accomplishment, and even help you live more comfortably.

Need some ideas on how to make money part-time quick? Click here.

Work with a financial planner

A certified financial planner (CFP) is a fantastic way to receive professional counseling and investment advice to make the most out of your saving experience. A financial advisor can help you determine the amount you’ll need to retire and can guide you on best-practice to investment strategies and financial freedom.

The FIRE Movement

FIRE stands for financial independence retire early. This is a particular strategy where early retirees keep an extremely high savings rate at a young age, which helps to maximize their nest egg. The theory is that this will allow them to stop working at a young age and live a minimalist lifestyle.

A big part of this philosophy is frugality — many adherents move to areas where the cost of living and rent/home prices are low. They may very well often give up vehicle ownership for cheaper modes of transport, like biking or skateboarding. The FIRE method is a way to keep personal finances in check and maximize savings for retirement.

Is it time to retire?

It’s fair to say that retirement is not an open-and-closed book for many — it depends entirely on what you put into it. While hitting the jackpot in the state lottery is a surefire way to ensure a comfortable retirement, there are much more practical avenues to prepare yourself for leaving the workforce.

The best thing you can do if you’re thinking about retiring early is to take a look at your finances, consider your goals and aspirations for your future, and do your best to prepare and save. After you’re ready, go ahead and live life on your own terms — you deserve it, after all.